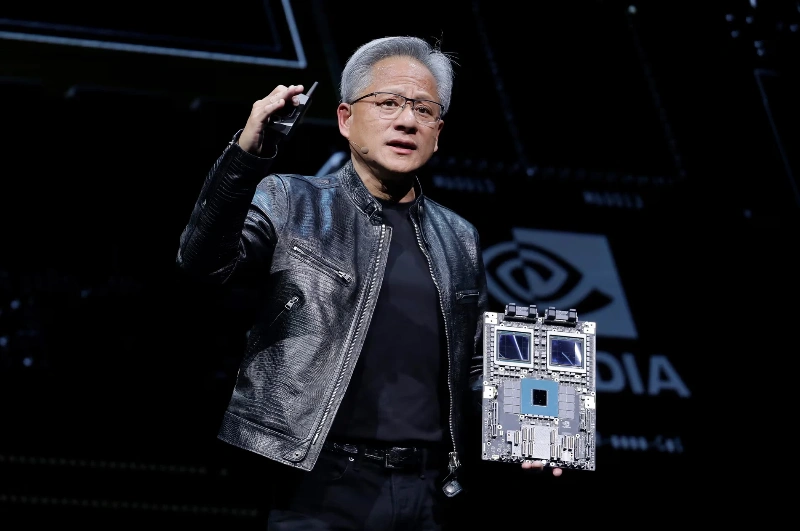

Nvidia Becomes the World's First $4 Trillion Company

On Wednesday, chipmaker Nvidia became the first public business in history to reach a $4 trillion market value, as its stock price continued its years-long meteoric rise.

The top chip designer's shares increased about 2.4% to $164, benefiting from the continuous surge in demand for artificial intelligence technologies. Nvidia's chips and associated software are widely regarded as world leaders in the development of AI technologies.

Nvidia reached a $1 trillion market value for the first time in June 2023, and the climb continued unabated, with its market value - the entire value of its shares - more than tripling in just a year, outpacing Apple and Microsoft, the only other US corporations with a market value of more than $3 trillion. In 2022, Apple became the first corporation to reach a valuation of $3 trillion.

Microsoft is the second-largest US firm, with a market value of approximately $3.75 trillion. Nvidia's worth is equivalent to 7.3% of the whole S&P 500, Wall Street's benchmark stock index. Apple and Microsoft account for approximately 7% and 6%, respectively.

Nvidia's stock has recovered almost 74% from its April lows, when Donald Trump's tariff barrage shook global markets. Nvidia is prohibited from selling its most advanced chips to China under US export rules, which the company has challenged.

However, optimism about trade partners achieving agreements with the US has recently buoyed equities, with the S&P 500 reaching an all-time high.

Daniel Ives, a tech analyst at Wedbush, predicts that more major tech companies will join Nvidia in the $4 trillion industry. "Nvidia and Microsoft lead the poster children for the AI revolution as both are foundational pieces of building on the biggest tech trend we have seen in our 25 years covering tech stocks on the Street," according to him.

According to Ives, Microsoft plans to reach $4 trillion "this summer" and then focus on $5 trillion over the next 18 months. The AI revolution is driving the current tech bull market, which is still in its early stages.